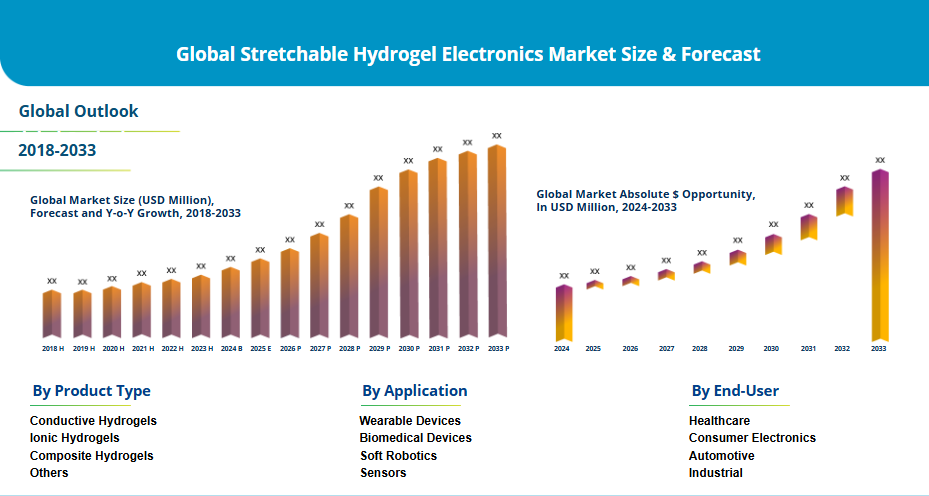

The global market for stretchable hydrogel electronics is on track to quintuple over the next decade, driven by rapid advances in materials science and rising demand for soft, biocompatible electronic components used in healthcare, wearables, and next-generation robotics. According to newly published industry research, the market—valued at $425 million in 2024—is expected to reach $2.1 billion by 2033, expanding at a 19.6% CAGR during the forecast period.

Stretchable hydrogel electronics represent a fast-emerging class of flexible materials engineered to conduct ions or electrons while maintaining the softness and elasticity of biological tissue. The technology is increasingly shaping the future of biomedical monitoring, personalized healthcare, smart textiles, and soft robotics as manufacturers search for materials that can integrate seamlessly with the human body or perform reliably in dynamic environments.

North America Leads as Asia Pacific Surges Ahead

North America accounts for 38% of global revenue in 2024, supported by strong university–industry research networks, high healthcare spending, and early adoption of advanced wearable and medical devices. The U.S. remains the dominant contributor, backed by a robust regulatory environment and extensive intellectual property activity that accelerates commercialization cycles in bioelectronics.

Asia Pacific, however, is projected to be the fastest-growing regional market, with a forecast CAGR of 22.3% through 2033. China, Japan, and South Korea—already home to major flexible electronics supply chains—are investing heavily in next-generation materials. Consumer enthusiasm for wearable health devices, coupled with government-backed initiatives in advanced materials research, is creating fertile ground for hydrogel-based technologies. Electronics giants in the region are incorporating stretchable hydrogel components into new wearables, biomedical devices, and soft robotic platforms, further accelerating uptake.

Growth is slower but emerging across Latin America and the Middle East & Africa, where infrastructure constraints, regulatory uncertainties, and lower R&D investment temper adoption. Yet rising demand for cost-effective healthcare solutions and digital transformation across industrial sectors is beginning to open new market entry points.

Innovation in Material Science Fuels Market Momentum

Hydrogel electronics benefit from sustained innovation in material engineering, including advances in conductivity, stretchability, and self-healing capabilities. Manufacturing processes such as roll-to-roll printing and scalable synthesis have reduced production costs, allowing companies to commercialize thinner, more durable, and more responsive devices.

These developments are fueling new product categories—skin-like biomedical sensors, smart wound dressings, flexible energy storage devices, and soft robotic actuators—that were previously unattainable using conventional electronic materials. The broader convergence of nanotechnology and bioelectronics is expanding the design space for hydrogel-based interfaces, enabling electronics that can stretch, twist, or autonomously repair damage.

Regulatory reforms are also playing a role. Governments across North America, Europe, and Asia are supporting advanced material research through grants, streamlined medical device approvals, and incentives for industrial innovation. These measures are shortening go-to-market timelines and encouraging more companies to invest in hydrogel-based platforms.

Wearables and Biomedical Devices Drive Application Growth

Wearable devices remain the largest application segment. Hydrogel-based electrodes and sensors are increasingly integrated into health-tracking watches, fitness bands, and skin-adhering patches. The ability of hydrogels to conform to skin, remain breathable, and collect precise physiological data positions them as preferred materials for next-generation consumer and clinical wearables. Challenges remain around battery life, long-term durability, and regulatory approvals for medical-grade devices, but demand is expanding steadily.

Biomedical devices—ranging from implantable sensors to drug-delivery systems—are one of the fastest-growing segments. Hydrogels’ tissue-like mechanical properties offer advantages for long-term integration within the body. Yet commercialization is limited by clinical testing requirements, supply chain demands for medical-grade materials, and higher production costs.

Soft robotics represents another high-growth category. Hydrogel-based components enable robots capable of delicate manipulation in surgery, manufacturing, and hazardous environments. While this field remains nascent, breakthroughs in stimuli-responsive and self-healing materials are expected to broaden adoption.

Hydrogel-based sensors and energy storage solutions are also gaining traction across industrial, consumer, and environmental monitoring applications, though issues of stability, system integration, and cost continue to influence scaling.

Healthcare Dominates End-User Demand

Healthcare accounts for more than 40% of global revenue, driven by rising adoption of wearable diagnostics, remote monitoring, and minimally invasive devices. Hydrogel electronics offer compelling advantages for patient comfort and continuous physiological data collection.

Consumer electronics is another fast-expanding end-user segment, as brands incorporate flexible electronics into smart textiles, flexible displays, and tactile interfaces. Automotive and industrial players are exploring hydrogel sensors for human-machine interfaces and flexible energy systems, though adoption remains early-stage.

Fragmented Competitive Landscape Shows Signs of Consolidation

The competitive landscape is moderately fragmented, with a mix of specialty chemical companies, electronics manufacturers, and material science innovators. Leading global players include 3M, DuPont, LG Chem, Dow Chemical, BASF, Hydromer, Evonik, DSM, Ashland, Henkel, Nippon Shokubai, Sumitomo Seika, Axalta, and Momentive, alongside healthcare giants such as Medtronic, Smith & Nephew, and Johnson & Johnson.

Major companies are investing heavily in R&D to develop next-generation hydrogel formulations while pursuing mergers, acquisitions, and global partnerships to strengthen product portfolios. Recent M&A activity, particularly among biomaterials start-ups and specialty chemical firms, reflects a broader trend toward strategic consolidation. Partnerships between material suppliers and device manufacturers are facilitating integrated solutions for specific end-use markets.

Cost pressures persist, especially in commoditized product segments such as basic conductive hydrogels, but differentiation is increasingly driven by functionality—self-healing capabilities, enhanced biocompatibility, and improved conductivity.

Emerging technologies—including stimuli-responsive hydrogels, hybrid hydrogel composites, and autonomous self-healing systems—are expected to propel the market into its next phase of commercialization. As these materials move from laboratory research to high-volume production, analysts expect transformative applications in digital health, consumer electronics, and soft robotics.