Swiss industrial conglomerate ABB Ltd. announced on Thursday that it has signed an agreement to divest its Robotics division to SoftBank Group Corp. (TSE: 9984) for an enterprise value of $5.375 billion, foregoing its previous plan to spin off the unit as a separately listed company. The transaction, which is subject to regulatory approvals and customary closing conditions, is expected to close in mid-to-late 2026.

Peter Voser, Chairman of ABB, said the offer from SoftBank was evaluated against the company’s original spin-off plan and was deemed to deliver immediate value to shareholders. “ABB will use the proceeds in line with its well-established capital allocation principles. Our ambitions remain unchanged, and we will continue to focus on our long-term strategy in electrification and automation,” Voser added.

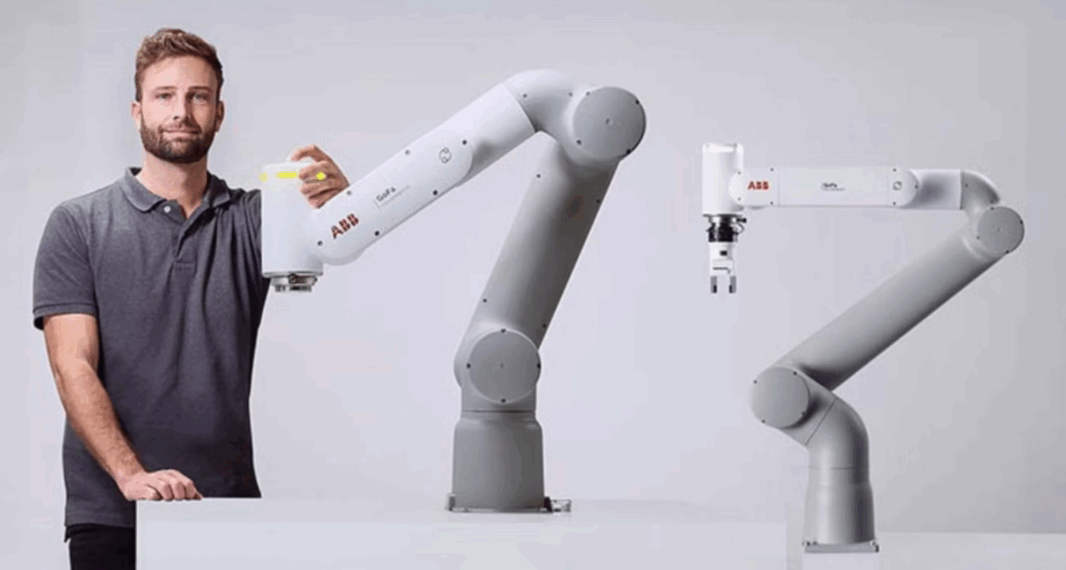

ABB CEO Morten Wierod emphasized that SoftBank would provide an “excellent new home” for the division and its employees. He noted that both companies share a vision for the emerging era of AI-driven robotics, and that the combination of ABB Robotics’ expertise with SoftBank’s advanced capabilities in AI and next-generation computing will strengthen the business’s leadership in industrial robotics.

Masayoshi Son, Chairman and CEO of SoftBank Group, described the acquisition as part of SoftBank’s push into “Physical AI.” He highlighted the potential to combine ABB Robotics’ technology with SoftBank’s Artificial Super Intelligence initiatives, aiming to drive “a groundbreaking evolution” in robotics.

The deal will lead to restructuring within ABB. From the fourth quarter of 2025, the Robotics division will be reported as discontinued operations, while the Machine Automation division will merge into ABB’s Process Automation business area. The divestment is expected to generate a non-operational pre-tax book gain of approximately $2.4 billion, with net cash proceeds of about $5.3 billion. Estimated separation costs are around $200 million, half of which is already included in 2025 guidance, and transaction-related cash tax outflows are projected between $400 million and $500 million.

ABB Robotics, employing approximately 7,000 people, accounted for $2.3 billion in revenues in 2024, representing roughly 7% of ABB Group’s total revenues. The unit reported an Operational EBITA margin of 12.1%, reflecting its established profitability despite limited business and technology synergies with ABB’s remaining operations.

Industry analysts note that the sale aligns ABB with its core focus on electrification and automation while enabling SoftBank to expand its robotics and AI ambitions. The transaction also highlights the growing convergence of industrial automation and advanced AI technologies, with major conglomerates and tech investors seeking to capitalize on the next generation of robotics-driven manufacturing and service solutions.