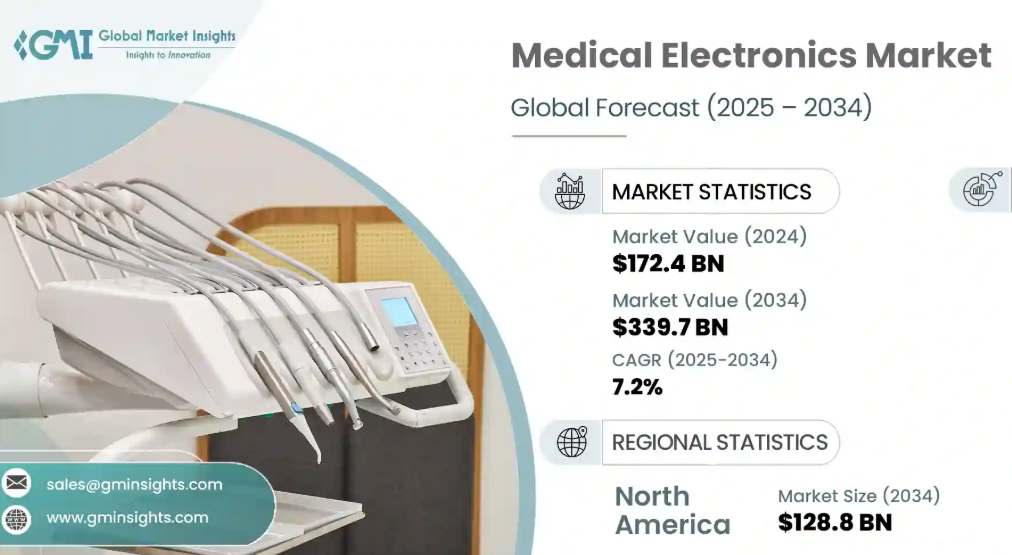

The global medical electronics market is set for robust growth over the next decade, projected to expand from USD 182.3 billion in 2025 to USD 339.7 billion by 2034, at a compound annual growth rate (CAGR) of 7.2%, according to a recent report by Global Market Insights. Rising prevalence of chronic diseases, technological innovation, and increasing adoption of minimally invasive procedures are cited as key drivers of market expansion.

Medical electronics encompass a broad spectrum of devices and systems used in healthcare to diagnose, monitor, treat, and prevent medical conditions. These include implantable therapeutic devices, diagnostic imaging systems, wearable monitors, and surgical robots. The sector has seen accelerated demand due to growing global incidences of cardiovascular disorders, neurological diseases, cancer, and chronic kidney disease (CKD). For example, CKD affects an estimated 100 million individuals in Europe and is projected to become the fifth leading cause of death worldwide by 2040, according to the European Kidney Health Alliance.

Therapeutics Segment Leads Market Growth

The therapeutics segment, which includes pacemakers, implantable cardioverter-defibrillators, neurostimulation devices, respiratory care equipment, and surgical robots, accounted for USD 77.1 billion in 2024. The segment is projected to sustain a CAGR of 7.4% through 2034, driven by rising demand for precision treatment and patient-specific therapies.

Innovations in electronic components, miniaturization, AI integration, and wireless connectivity are making therapeutic devices more efficient, accessible, and patient-friendly. Medtronic’s Percept PC neurostimulator, which integrates sensing and directional stimulation for neurological disorders, exemplifies this trend. Similarly, robotic-assisted surgical systems enhance procedural precision and reduce patient recovery time, supporting the shift toward minimally invasive surgeries.

Diagnostic Devices and AI Integration

Advances in diagnostic electronics are also contributing to market growth. Imaging systems like GE Healthcare’s LOGIQ E10 ultrasound, powered by AI-based cSound architecture, and Philips’ IQon Spectral CT, capable of delivering multi-layered data in low-dose scans, demonstrate the growing importance of AI and high-resolution electronics in improving diagnostic accuracy and workflow efficiency. Wearable and remote monitoring devices further reinforce this trend, enabling real-time patient data collection and predictive health management.

Regional Market Outlook

North America led the market in 2024 with revenues of USD 66 billion and is expected to reach USD 128.8 billion by 2034, largely due to high prevalence of chronic diseases and advanced healthcare infrastructure. In the U.S., cardiovascular disease remains the leading cause of death, driving the adoption of diagnostic and therapeutic electronics.

Europe, particularly the U.K., is expected to experience steady growth, driven by an aging population and strong demand for precise diagnostic systems. The elderly population aged 85 and above is projected to increase from 2.5% in 2020 to 4.3% by 2040, boosting demand for medical electronics. Japan is emerging as a key market in Asia Pacific, with high adoption rates for MRI, CT, and X-ray devices, coupled with an aging demographic requiring frequent health monitoring.

In the Middle East and Africa, Saudi Arabia is seeing significant market expansion supported by national healthcare initiatives, Vision 2030 reforms, and investments in advanced diagnostic infrastructure.

Market Challenges and Supply Chain Considerations

Despite strong growth prospects, the market faces challenges, including regulatory hurdles and a shortage of skilled healthcare professionals capable of operating advanced electronics. Trade tensions and tariffs on imports from key manufacturing countries like China could increase production costs, prompting companies to diversify supply chains to countries such as India, Vietnam, Malaysia, and Eastern Europe. Localized manufacturing and R&D investment are increasingly seen as strategies to mitigate these risks.

Competitive Landscape

The market remains concentrated, with the top four players—Abbott Laboratories, GE HealthCare, Koninklijke Philips, and Medtronic—holding roughly 45% of the market share. These companies maintain dominance through innovation, strategic partnerships, regulatory compliance, and robust distribution networks. Recent product launches, such as FUJIFILM Healthcare’s SCENARIA View Focus Edition CT system and Philips’ AI-enabled CT 5300, underscore the role of technology in market leadership.

Outlook

According to Global Market Insights, the medical electronics market is entering a transformative phase, driven by chronic disease prevalence, technological advancement, and the adoption of AI-enabled, minimally invasive, and patient-specific solutions. With global revenues expected to nearly double by 2034, the sector is poised to play an increasingly critical role in healthcare delivery, shaping diagnostics, therapeutics, and overall patient outcomes worldwide.